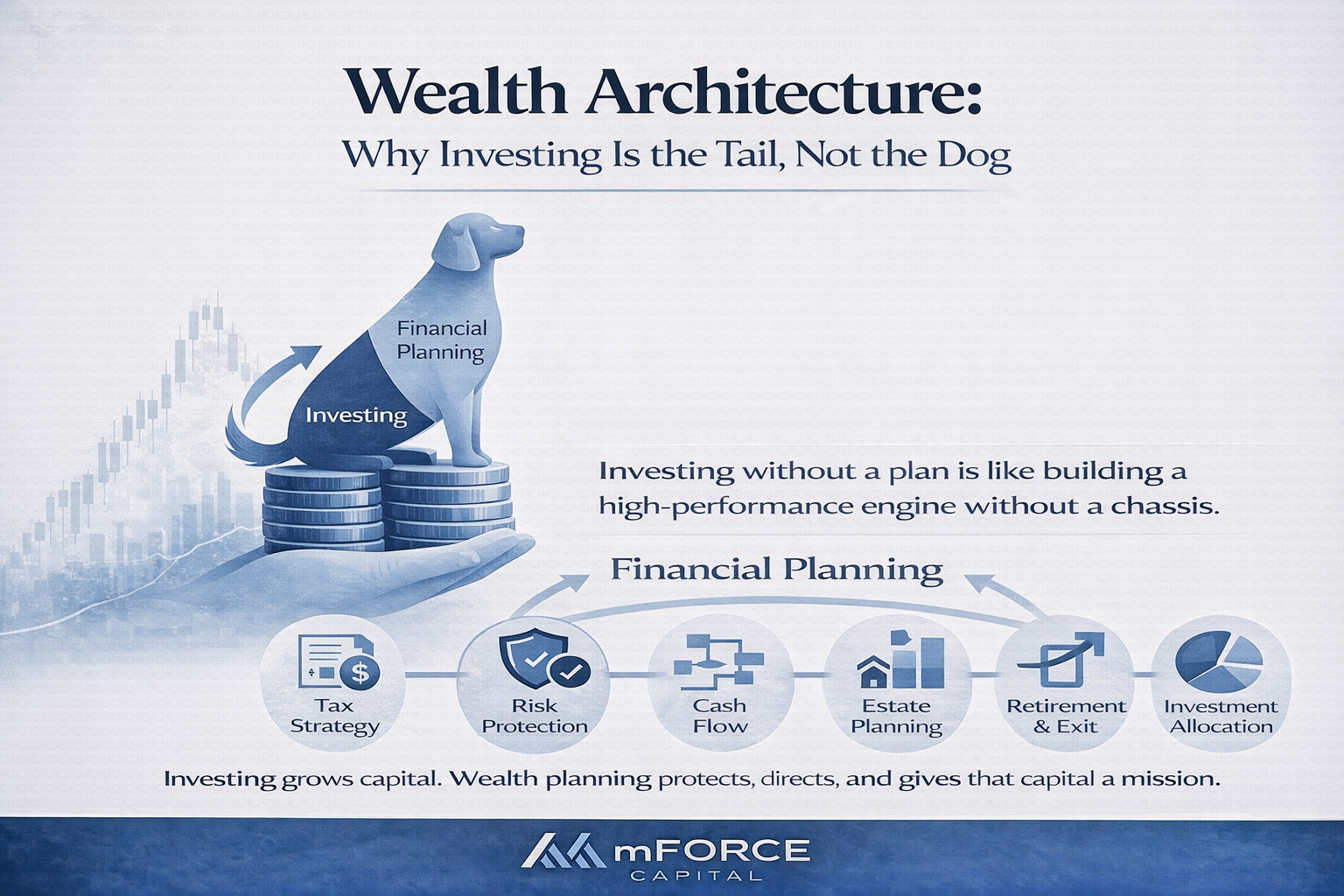

Wealth Architecture: Why Investing is the Tail, Not the Dog

In the world of HNW & UHNW wealth management, there is a common category error: treating "investing" and "financial planning" as synonyms. They are not. If you are focused solely on your portfolio's alpha, you are likely ignoring the massive "leakage" occurring in taxes, estate structural flaws, and misaligned cash flows.

What is the Difference Between Investing and Financial Planning?

- Investing is the process of acquiring assets with the expectation of generating a return. It is a component.

- Financial Planning is the comprehensive orchestration of your entire balance sheet to ensure your capital meets your specific life objectives. It is the system.

The 6 Pillars of Comprehensive Wealth Management

A high-performing portfolio is useless if it is liquidated to pay an avoidable tax bill or lost in a poorly structured estate transition. A true financial plan coordinates these moving parts:

- Tax Alpha: For HNW individuals, what you keep is more important than what you earn. This includes location optimization, tax-loss harvesting, and structured giving.

- Liability & Risk Management: Protecting the fort. This involves specialized insurance, asset protection entities (LLCs/Trusts), and coordination of one’s insurance needs.

- The "Traction" Cash Flow System: Just as you use EOS to manage your business's bottom line, your personal "operating system" must dictate how much is reinvested, how much is spent, and how much is reserved for liquidity.

- Estate & Legacy Design: Moving beyond a simple will. This is about the frictionless transfer of both your "human capital" and your financial capital to the next generation or charities.

- Retirement & Exit Strategy: For business owners, your business is often your largest asset. Planning focuses on the liquidity event, ensuring the business exit aligns with your personal lifestyle needs.

- Investment Allocation: The engine that powers the growth to ensure and maintain your legacy.

Why Purpose Outperforms Performance

Investing without a plan is like building a high-performance engine without a chassis. You might have the power, but you have no way to steer. When the market turns volatile, an "investment-only" strategy leads to emotional decision-making. A "plan-first" strategy provides the lucidity to stay the course because you know exactly which bucket of capital is for "today" and which is for "ten years from now."

Takeaway: Investing grows your capital. Financial planning protects, directs, and gives that capital a mission.

Articles You May Also Find Helpful

The roadmap to financial success

A step-by-step PDF that outlines the key financial milestones individuals and families should aim for, including wealth preservation, estate planning, and legacy building.

.png)